The Cedar Rapids Metro commercial real estate market is experiencing a period of growth and innovation in 2025, driven by over $1.3 billion in data center investments and a wave of adaptive redevelopment projects reshaping the area’s economic landscape. The combination of Google and QTS data center developments, strategic industrial expansion, and creative property repositioning demonstrates Cedar Rapids’ emergence as a hub for technology, manufacturing, and mixed-use development.

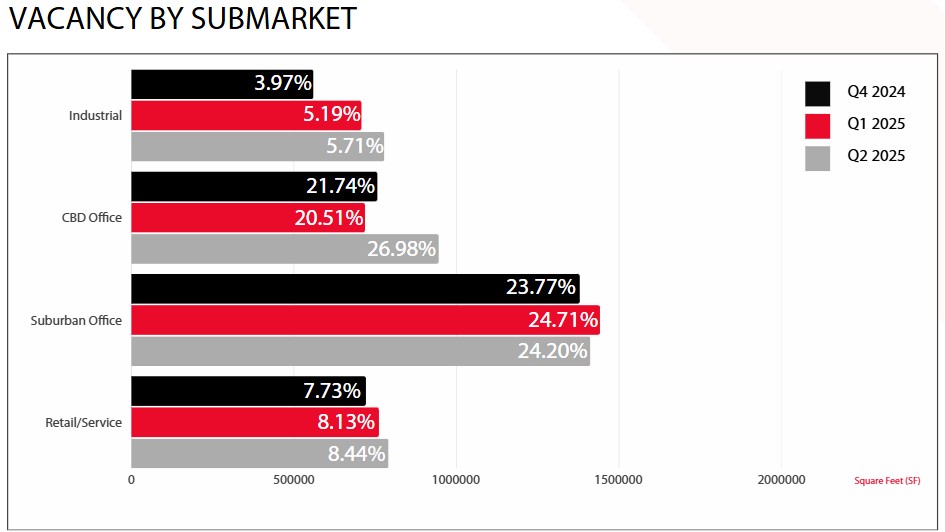

The market data reveals investment opportunities across all property sectors, with industrial properties leading the charge at a 5.71% vacancy, while office and retail sectors undergo strategic transformations that create value-add opportunities for forward-thinking investors.

Industrial Sector: Powering Regional Economic Growth

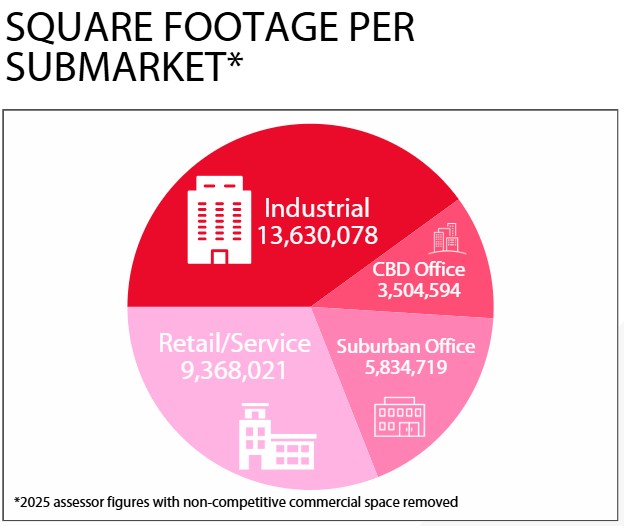

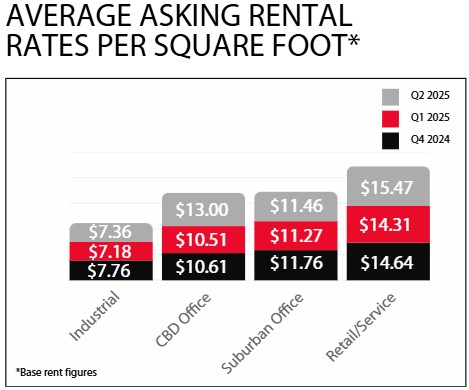

Cedar Rapids’ industrial real estate market continues its expansion trajectory, encompassing 13.6 million square feet with a 5.71% vacancy rate and an average asking rental rate of $7.36 per square foot.

The industrial sector’s exceptional performance stems from Cedar Rapids’ positioning as a technology infrastructure hub serving the artificial intelligence and cloud computing industries. Iowa’s first certified mega site, Big Cedar Industrial Park, offers companies cost-effective land and utilities with immediate access to $1.326 billion in combined investment from Google and QTS Data Centers throughout 2025.

QTS Data Centers has dramatically expanded their commitment from an initial $750 million to $10 billion development spanning 25 years, representing the largest economic development project in the state’s history. The 612-acre campus will feature seven state-of-the-art data center buildings ranging from 400,000 to 1.1 million square feet.

Manufacturing expansion complements technology growth through projects like Danisco US Inc.’s $70 million expansion and multiple warehouse developments along strategic transportation corridors. These investments reinforce Cedar Rapids’ competitive advantages as a manufacturing and distribution center serving regional and national markets.

Office Market: Innovation Through Adaptive Transformation

The Cedar Rapids office market shows strategic adaptation and creative repositioning in response to evolving workplace preferences. The Central Business District’s 3.5 million square feet shows a 26.98% vacancy with average asking rents of $13.00 per square foot, creating opportunities for innovative tenants and adaptive reuse projects. Suburban office properties totaling 5.8 million square feet offer 24.20% vacancy at asking rental rates of $11.46 per square foot.

Retail and Service Properties: Consistent Performance and Strategic Growth

The retail and service sector maintains solid market fundamentals with 9.4 million square feet and an 8.44% vacancy rate. Average asking rents of $15.47 per square foot reflect consistent tenant demand for well-positioned retail locations throughout the metro area. The sector is set to benefit from exciting redevelopment projects, including the $25 million Sears conversion into Dick’s House of Sport and numerous restaurant and retail space renovations.

High-profile retail transactions such as the $17.5 million Northland Square shopping center sale demonstrate continued investor confidence in established retail properties with strong tenant profiles and strategic locations.

Market Opportunities

The 2025 midyear market outlook confirms Cedar Rapids’ exciting transformation as a technology and manufacturing hub while successfully adapting to modern business needs across all property sectors. Strategic investors and businesses who recognize these market opportunities and position accordingly can benefit from the significant growth potential this evolution creates throughout the Cedar Rapids Metro commercial real estate market.

A Sample of Significant Transactions — Announced, In Progress, Completed, Etc.

Industrial

- Announced — 1000 41st St. Dr. SW, Cedar Rapids — $70M Danisco US Inc. expansion

- In progress — 76th Ave. & Edgewood Rd. SW, Cedar Rapids — $576M Google data center

- In progress — 76th Ave. & Edgewood Rd. SW, Cedar Rapids — $750M QTS data center

- (GLD) In progress — 8205 6th St. SW, Cedar Rapids — $15M project with 3 warehouses on 19 acres

- (GLD) Sold — 6915 & 7221 Edgewood Rd. SW, Cedar Rapids — 78 acres of industrial development land

- (GLD) Sold — 1012 66th Ave. SW, Cedar Rapids — 10,150 SF flex building sold and subsequently leased

- (GLD) Sold — 2720 64th Ave. SW, Cedar Rapids — 50,176 SF building sold to Zurcher Tire

Office

- (GLD) Announced — 101 1st Ave. SE, Cedar Rapids — $5.3M in upgrades to former UFG building for CR City Annex

- Announced — 411 10th St. SE, Cedar Rapids — UIHC Health Care to purchase MedQ building

- Opened — 1450 N. Center Point Rd., Hiawatha — 22,000 SF UnityPoint Health PACE Senior Care center

- Opened — 116 6th St. NE, Cedar Rapids — $19M 34,000 SF Cedar Rapids Bank & Trust office building

- (GLD) Leased — 200 1st St. SE, Floors 17 & 18, Cedar Rapids — 10,129 SF in the Alliant Tower to United Life

- Sold — 415 12th Ave. SE, Cedar Rapids — The Geonetric Building sold for $6.8M

- (GLD) Sold — 5250 N. River Blvd. NE, Cedar Rapids — Fully-leased office building sold to an investor

- (GLD) Sold — 1125 Dina Ct., Hiawatha — 35,294 SF office building sold for 2pifi headquarters relocation

Retail/Service

- Announced — 4600 1st Ave. NE, Cedar Rapids — $25M Sears redevelopment into Dick’s House of Sport

- Announced — 1625 J St. SW, Cedar Rapids — redevelopment of Save-A-Lot into Dollar Store

- In progress — 2345 Edgewood Rd. SW, Cedar Rapids — redevelopment of AMC Classic theater into a trampoline park

- (GLD) In progress — 2350 Edgewood Rd. SW, Cedar Rapids — redevelopment of Sugarfire BBQ into 7-Brew

- (GLD) Pending — 3210 Center Point Rd. NE, Cedar Rapids — sale pending with a quick service restaurant

- (GLD) Pending — 4415 Williams Blvd. SW, Cedar Rapids — sale pending with Tractor Supply

- Sold — 321 Collins Rd. NE, Cedar Rapids — Northland Square shopping Center sold for $17.5M

- (GLD) Sold — 3939 1st Ave. SE, Cedar Rapids — former Outback Steakhouse property

- SOLD — 3220 Wiley Blvd. SW, Cedar Rapids — former Westdale Used Car Superstore sold to Kubota

Special Purpose/Mixed-Use

- Announced — 1095 6th Ave., Marion — multi-story mixed-use development on former library site

- In progress — 1107 7th Ave., Marion — construction began on the second Broad + Main building

- In progress — 3445-3355 stone Creek Circle SW, Cedar Rapids — 92-unit apartment complex

- In progress — 200 block F Ave. NW, Cedar Rapids — $275M Cedar Crossing Casino

- In progress — 1st Ave. & 1st St. SW, Cedar Rapids — 123-room AC Hotel by Marriott

- (GLD) In progress — 900 3rd St. SE, Cedar Rapids — Newbo Loftus 5-story mixed-use building

- Opened — 5993 Carlson Way, Marion — 93-room Holiday Inn Express

Ready to invest in Cedar Rapids commercial real estate? Contact GLD Commercial at 319.731.3400.